LME Metal March 2025 Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

The Electric bike materials March 2025 purchase indicators are like below:

Moving commodities in March: Cobalt showed a major price increase of 56%, while nickel and copper rose by 4.5% and 4.8% respectively (in USD prices).

LME Metal Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

Original: www.lme.com

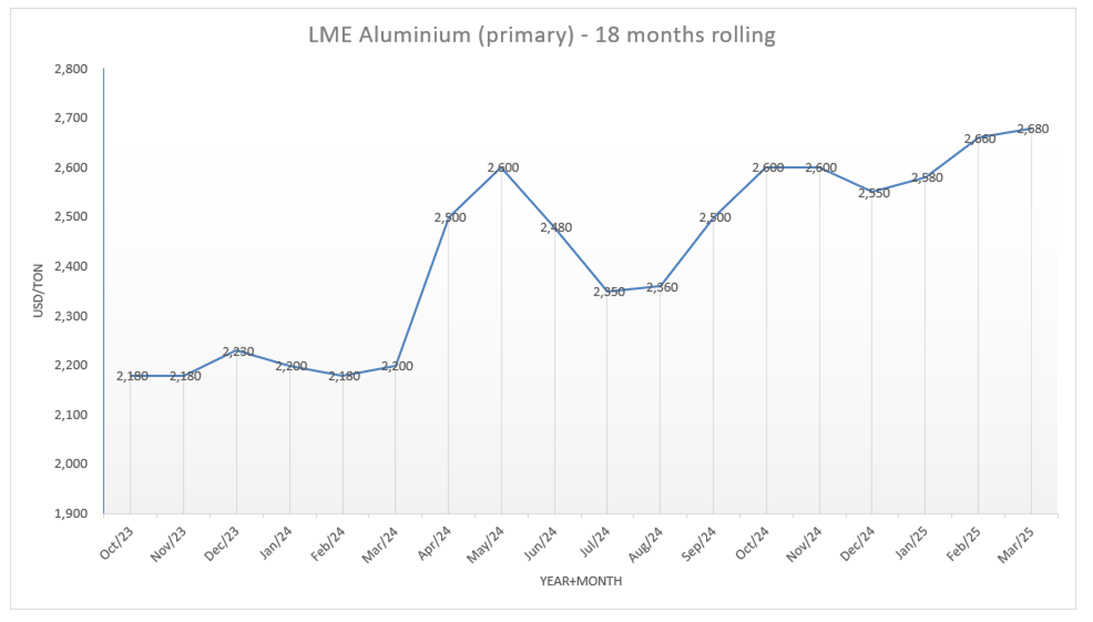

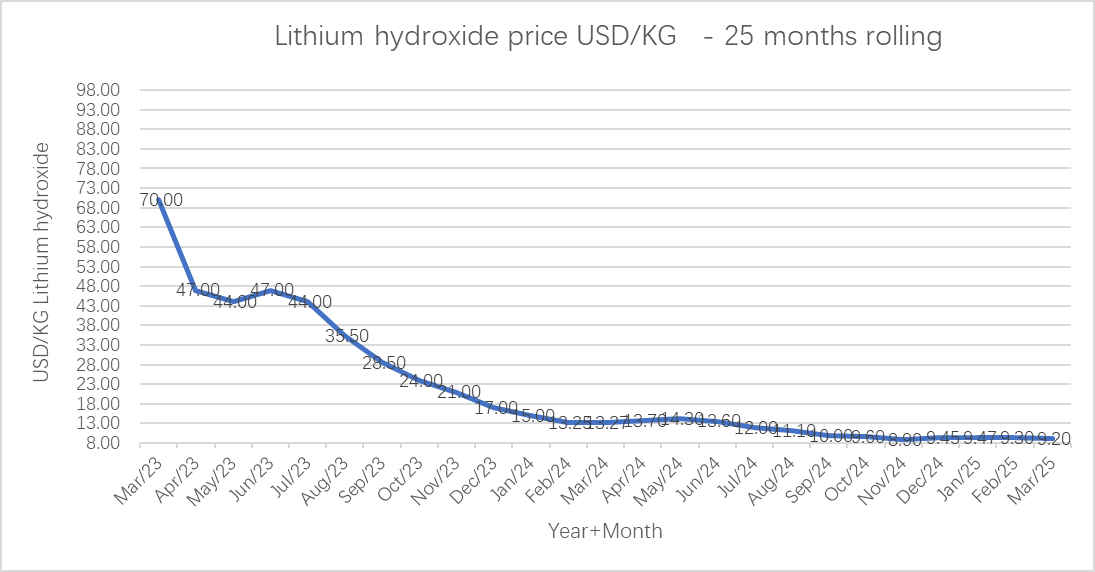

LME metals in 12 months: ( Lithium USD/kg, others USD/ton)

LME Metal March 2025 Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

The Electric bike materials March 2025 purchase indicators are like below:

Moving commodities in March: Cobalt showed a major price increase of 56%, while nickel and copper rose by 4.5% and 4.8% respectively (in USD prices).

LME Metal Purchase indicators –Steel, Aluminum, Nickel, Cobalt, Lithium Hydroxide price and market overview

Original: www.lme.com

LME metals in 12 months: ( Lithium USD/kg, others USD/ton)

| Metal Materials | Apr-24 | May-24 | Jun-24 | Jul-24 | Aug-24 | Sep-24 | Oct-24 | Nov-24 | Dec-24 | Jan-25 | Feb-25 | Mar-25 |

| Steel LME Far East 3 months | 385 | 385 | 385 | 390 | 365 | 375 | 385 | 360 | 350 | 350 | 365 | 375 |

| Aluminium LME 3 months | 2,500 | 2,600 | 2,480 | 2,350 | 2,360 | 2,500 | 2,600 | 2,600 | 2,550 | 2,580 | 2,660 | 2,680 |

| Aluminium China local | 20,000 | 21,000 | 21,000 | 20,000 | 19,600 | 20,400 | 20,900 | 20,600 | 20,600 | 20,200 | 20,550 | 20,700 |

| Nickel | 18,600 | 19,800 | 17,500 | 16,400 | 16,300 | 16,300 | 17,000 | 15,700 | 15,500 | 15,400 | 15,400 | 16,100 |

| Copper | 9,400 | 10,100 | 9,600 | 9,400 | 9,000 | 9,300 | 9,500 | 9,000 | 8,950 | 8,950 | 9,300 | 9,750 |

| Cobalt (3 months buyer) | 27,600 | 26,900 | 26,300 | 25,900 | 24,500 | 23,600 | 23,800 | 23,800 | 23,800 | 23,800 | 21,000 | 32,800 |

| Lithium Hydroxide | 13.70 | 14.30 | 13.60 | 12.00 | 11.10 | 10.00 | 9.60 | 8.90 | 9.45 | 9.47 | 9.30 | 9.20 |

Steel: prices rose from USD 365/ton to USD 375/ton in March (+2.7%).

- The US raised its tariffs on China to 145% in the latest round of escalation in response to China’s 125% tariffs on US goods.

- Even though a portion of the US tariffs exclude steel, and steel trade between the two countries is a small fraction of global flows, the escalating trade war between China and the US pressured the outlook on construction and manufacturing for the world’s top ferrous metal consumer.

- The impact of tariffs on Chinese steel was lower than those in base metals, as economic aid from Beijing is set to support household consumption and property developers’ financial health.

- Beijing signaled it will cut capacity for steel mills as a reaction to protectionist trade from Vietnam, South Korea, and Brazil.

Aluminium: prices moved a little from USD 2,660/ton to USD 2,680/ton in March (+0.8%).

- The US has reinstated 25% tariffs on steel and aluminium from key trading partners, including Canada, Mexico, and the EU, while also imposing a 200% tariff on Russian aluminium.

- Major alumina producers in Guinea and Australia added new capacity to recover from disruptions last year.

- China produced 44 million tons of aluminium in 2024, a new record. However, supply growth in China is expected to slow as the current output level close to the output cap of 45 million tons.

Local aluminium prices in China rose from CNY 20,550/ton to CNY 20,700/ton in March(+0.8%).

Nickel: prices increased from USD 15.4K/ton to USD 16.1k/ton in March (+4.5%).

- China announced a 125% tariff on all US exported products, in response to recent US tariffs.

- Nickel stockpiles on LME have increased, with Chinese-processed Indonesian nickel now accounting for over 50% of LME inventories (11% at the start of 2024).

- Indonesia’s surging refined metal output is further saturating the market.

Cobalt: prices burst from USD 21K/ton to USD 32.8K/ton in March (+56.2%).

- Cobalt prices in China jumped on China’s strategic buying of cobalt and talks of extension of export ban from the Democratic Republic of Congo, the top supplier of the battery material.

Lithium Hydroxide: price decreased from USD 9.3/kg to USD 9.2/kg in March (-1%).

- Sales in China rose by 38%, to 991,000 tons in March, but missed a forecast 1 million tons despite ongoing government subsidies that promote vehicle exchanges and energy transition technologies. Battery inventories remain elevated.

- Supply is not expected to slow as lithium miners are not willing to close operations in order to retain market share and business relationships with governments and battery producers.

Leave a Reply

Want to join the discussion?Feel free to contribute!